Interest rates, monthly payments, and the average time it takes to default on a car loan have little to do with where you live. Instead, they are established based on the applicant's financial situation (credit score, history, income, debts, loan amount, term, etc.). The statistics, when broken down by state, do, however, reveal typical driving patterns in each jurisdiction.

According to TransUnion, the auto delinquency rate has been rising over the past year, which means it is back to pre-pandemic levels. The resurgence of delinquencies after pandemic aid is mainly responsible for this rise.

How To Acquire A Car Loan?

Vehicle financing options are plentiful. Most people get loans from banks or credit unions, but online lenders are also an option. No matter where you're going, though, you can save money by following these guidelines:

- Compare rates from at least three different lenders by shopping around.

- Submit an application for prequalification on loan to clearly understand your monthly costs.

- Be honest about your financial background and vehicle information on the loan application.

- Commence making monthly loan payments.

Data On Auto Loan Repayment

- According to Experian, the typical instalment cost for a brand-new vehicle is $667 per month.

- According to Experian, the typical cost to finance a used car is $515 per month.

- According to Kelley Blue Book, the regular price of a brand-new vehicle is $48,301.

- According to Experian, the typical loan length for a new car is 69.46 months.

- New car loans have an average interest rate of 4.33 per cent, as reported by Experian.

- According to Experian, the average loan length for a used car is 68.01 months.

- According to Experian, the average interest rate for financing a used vehicle is 8.62%.

- In the United States, drivers typically put down $6,026.

Monthly Car Payments Depending On Credit Score

The interest rate you pay for your vehicle is based on various factors such as your credit, the vehicle type and the terms you choose. According to Experian's data from the second quarter, the average interest rate for a new vehicle loan is 4.33 per cent. The average interest rate for a used vehicle loan is 8.62 per cent.

Average Used Car Price By State

In 2022, the cost of a new car reached an all-time high. Kelley report that the average price of a new car will be over $48,000 in the summer of 2022, an increase of 11.9% from the summer of 2021.

According to Kelley Blue Book, the average price of a used car in September was $28,237, which is an encouraging sign that the market for pre-owned vehicles is stabilizing. According to Experian, SUVs continue to dominate the market, accounting for more than 60% of financed cars in the second quarter of 2022.

Default Rates On Auto Loans By State

The average delinquency rate is high in Texas, the state with the highest average car payment, but it is not the highest among the top states. There is a significant gap between the state of Mississippi and the national averages shown below, with Mississippi's 6.14 being the highest.

TransUnion's research, however, shows that auto loans continue to be valued by consumers at about the same level as other debt. Drivers prioritize making car payments second only to mortgage payments and much higher than payments to credit card companies.

Late Payments On Auto Loans Are Increasing.

Since the pandemic's beginning, when many drivers' payments were bolstered by pandemic-related recovery programs, auto delinquency rates have increased.

State Totals For Auto Loans That Are Lowest In Each

Hawaii's average auto loan balance is the lowest in the country, followed closely by Massachusetts, where the Mayflower first landed. The average in these states is significantly lower than the median of $5,210 across the country. But as explained, the auto loan balance is independent of ZIP code and relates to each state's typical background. Financial literacy, income and cost of living all play essential roles.

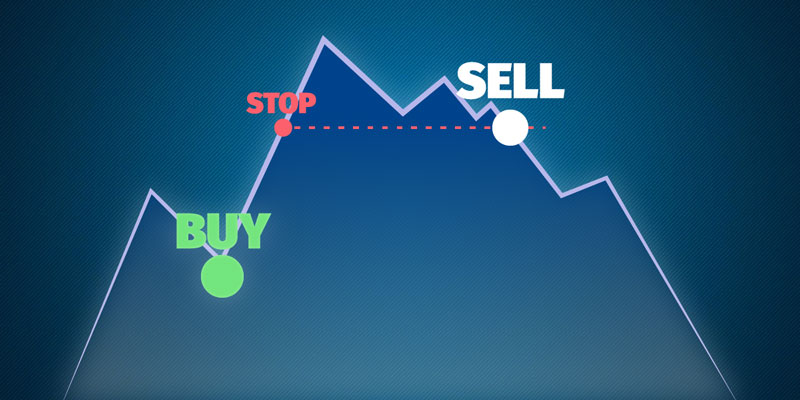

How Do I Refinance My Car Loan?

You can refinance your car loan in a manner not dissimilar to how you initially obtained it. It would help if you looked over your current loan, paid attention to the interest rates and terms, and then visited several different lenders before committing to a new loan.

What Is A Reasonable Interest Rate For A Car Loan?

Interest rates are based on several variables, including credit history, vehicle age, and loan term. According to Experian, the average interest rate for both new and used vehicles was 4.33 per cent.